Focusing on What Matters During Trade Tensions

For many investors, the return of market volatility is déjà vu all over again. Recent swings in global stocks and bonds are the result of escalating trade tensions and fears of an economic slowdown. What has changed in recent weeks and how should long-term investors react to these events?

Over the past month, trade talks between the U.S. and China have deteriorated with tariffs rising from 10 to 25% on $200 billion worth of goods imported by the U.S. These tariffs could expand to additional goods if progress isn’t made. In retaliation, China has raised its own tariffs on $60 billion of U.S. goods. Underlying these trade talks are thorny issues such as intellectual property rights and currency manipulation.

In addition, the administration last week suggested that it may increase tariffs on Mexico. As is the case with China, tariffs against Mexico are in response to difficult underlying issues – in this case, migration and border security. At the moment, the U.S. is threatening to impose a 5% tariff on all imported goods beginning in June, which would then increase each month up to 25%.

As has been the situation for well over a year, trade tensions are a significant source of uncertainty for markets. Even if acceptable trade deals are ultimately reached, the short-term effect is that investors could experience wild market swings. Recent developments increase this uncertainty since it’s not clear when these trade issues might be resolved, and what would be included in each deal.

One reason increased tariffs with Mexico has rattled investors is that it was believed that a deal between the U.S., Mexico and Canada has been reached several months ago. While this trade agreement, which would replace NAFTA, still needs to be ratified, it appeared as if this process were underway.

In response to this uncertainty, both U.S. and global markets have pulled back between 6 and 7% from last month’s all-time highs. Additionally, interest rates have declined to multi-year lows with the U.S. 10-year Treasury yield reached 2.14% at the end of last week – the lowest since 2017 – and the 2-year yield fell below 2%.

However, it’s always important to view these market moves in the right context and with perspective. Despite this pullback, U.S. stocks are still up over 10% this year, developed markets are up about 8%, and emerging markets 4%. And while trade worries may be affecting interest rates, recent moves are also consistent with more “patient” Fed policy. With the market expecting a rate cut by the Fed later this year, based on fed funds futures, there could continue to be a ceiling on interest rates.

Ultimately, current market volatility is the result of the same headlines that have rattled markets for well over a year. Investors should remain disciplined and properly diversified in the face of this cloud hanging over markets. After all, it is still more likely than not that trade agreements are reached with both China and Mexico. However, because this may take many months – or perhaps longer – investors should maintain a long-term focus to avoid falling prey to short-term volatility.

1. Trade tensions continue to be front and center for global markets

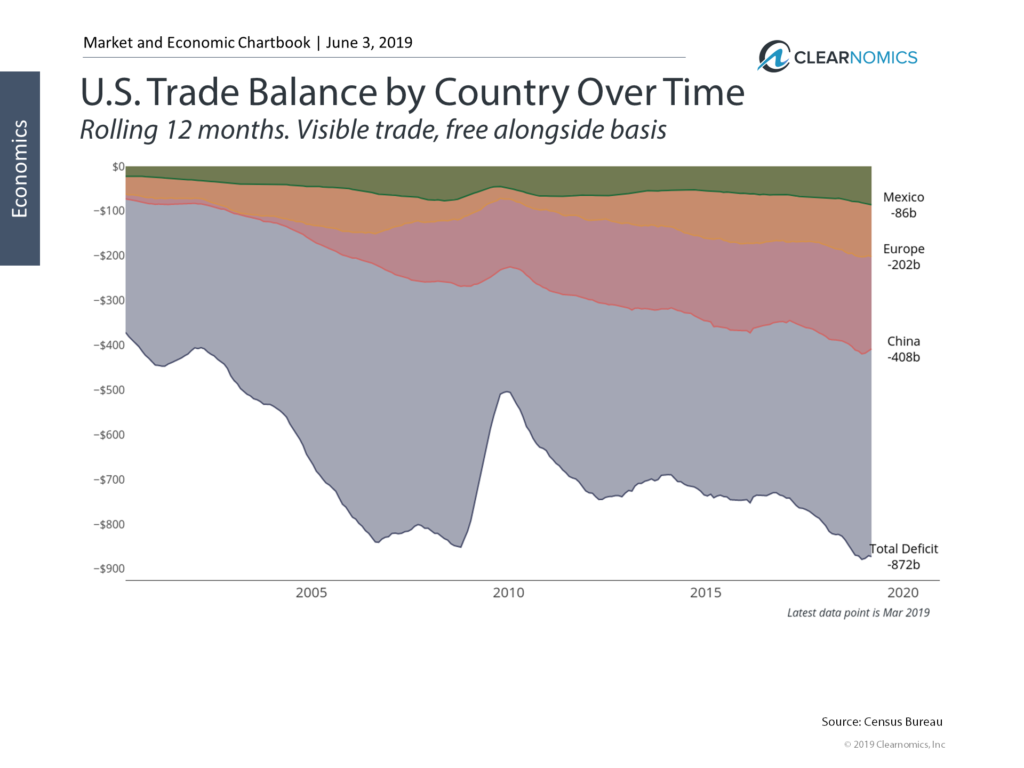

U.S. Trade Balance by Country Over Time

Find this chart under “Global Trade”

Markets continue to react to ongoing threats of trade tariffs between the U.S. and its major trading partners. This is because trade policy has been a key political issue for the administration.

The chart above shows the U.S. trade balance across major trading partners – and the growing size of our largest deficits. Countries such as China and Mexico are easy political targets due to our sizable imbalances with these trading partners.

However, the U.S. ran significant trade deficits with our other allies as well, including the European Union and Japan. Thus, no country, whether an ally or not, is safe from potential trade renegotiation. This has increased market uncertainty.

2. Global market performance should be viewed with perspective

Global Market Returns in Perspective

Find this chart under “Global Stocks”

As a result of global uncertainty around trade, both U.S. and global markets have pulled back in the past month. The chart above shows the performance of the MSCI All Country World Index over three time periods.

While the global market is in negative territory relative to last year’s peak and the year-to-date high from last month, it has still done quite well over the past two years. So, although continued trade tensions may weigh on markets, recent volatility should be taken with the proper perspective.

3. Interest rates have plummeted to multi-year lows

Interest Rates

Find this chart under “Interest Rates”

Trade uncertainty has also weighed on U.S. interest rates which have pulled back significantly in just a matter of weeks. The Fed has also played a significant role in falling rates by emphasizing that they will continue to be patient with their interest rate policy. At the moment, fed funds futures are pricing in a 97% probability of a rate cut by December of this year.

While uncertainty may continue to weigh on interest rates, the message to investors is clear: those who need portfolio income will need to continue to find alternative sources such as dividend-paying stocks and high-yield debt, to name a couple.

The bottom line for investors? Trade tensions have been a cloud over markets for well over a year. Investors should continue to exercise discipline and patience to achieve their long-term goals.