Portfolio Income is Still a Challenge

Market volatility in recent weeks has pushed interest rates down even further. For many investors, low interest rates have been a challenge over the past ten years. It goes without saying that for those nearing or already in retirement, low rates have made it difficult to find portfolio income. Even for those with long time horizons, low rates have been puzzling given the health of the U.S. economy. What can investors expect from interest rates today?

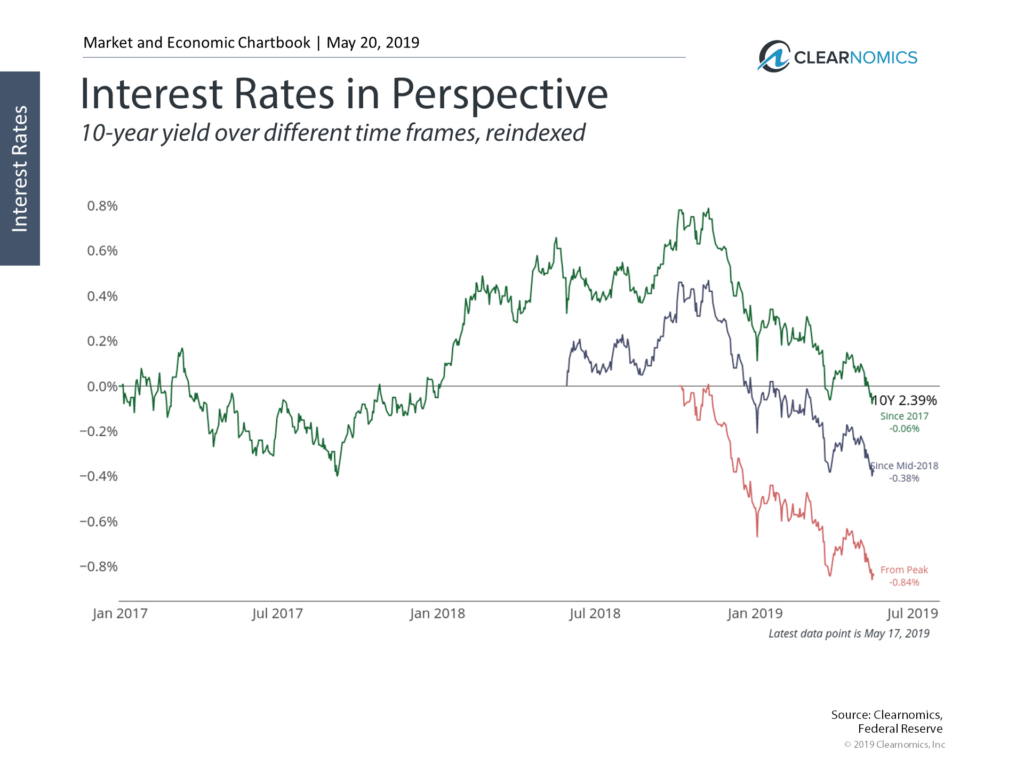

Last week, the 10-year Treasury yield fell to as low as 2.35%. It has been on a decline since last November when it peaked above 3.2% and, at the moment, the 10-year is where it was at the beginning of both 2017 and 2018. This continues the 40-year trend of declining interest rates since the late 1970s.

The fact that the Fed has reversed course on its rate hike policy has been one major factor. Short-term rates have declined in response to this, with the 2-year Treasury yield falling alongside longer-term rates. This has occurred despite the Fed’s actions being widely expected by investors, although market probabilities using fed funds futures still imply a rate cut later this year.

As is usually the case, these market trends bring good news and bad news. The good news is that most investors don’t appear to be over-reacting to recent volatility. The market has experienced larger swings in recent weeks, but they’ve been in both directions.

This is in stark contrast to Q4 last year when declining rates and a flattening yield curve were sounding alarm bells among investors. At the moment, the S&P 500 is still up 14% year-to-date, and the VIX volatility index is still around long-term averages.

The bad news is that there’s still no respite for those who need stable, long-term portfolio income. Sources of income such as dividend-paying stocks, alternative investments, high yield bonds, and even annuities, continue to be the only game in town. There’s nothing wrong with this – it simply requires investors to properly construct their portfolios and possibly with the right professional guidance. Balancing income with risk has been a defining challenge of this market cycle.

Thus, as is always the case, investing in the later stages of the business cycle will require increased discipline and patience. The many false-starts we’ve witnessed with rising long-term rates are likely to continue, especially with global tensions in the balance. It’s likely that those who stay invested and balanced across these periods will be in a better position to achieve their long-term financial goals.

Below are three charts that highlight trends in interest rates.

1. Interest rates have pulled back in recent weeks

Interest Rates in Perspective

Find this chart under “Interest Rates”

Interest rates fell to historic lows following the financial crisis due to slow global growth and easy central bank policy. Ten years later, long-term rates are still quite low, with the 10-year Treasury yield stuck below 2.4% today.

The chart above shows how rates have moved over the past several months, the past year and past two years. Interest rates have fallen from their peaks last year, and are still near levels from the beginning of 2017. There have been many false-starts for rising rates, including the 2013 “taper tantrum” and in late 2016 following the presidential election. However, long-term rates have failed to stay durably higher.

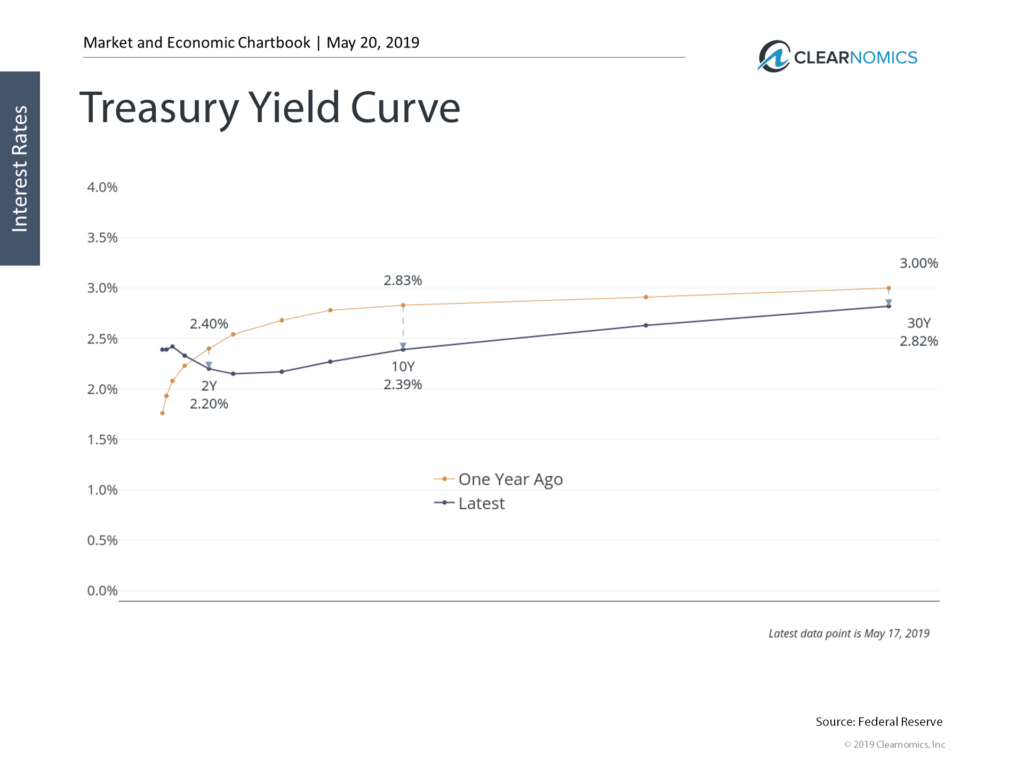

2. The yield curve is still flat at the long end, and inverted at the short end

Treasury Yield Curve

Find this chart under “Interest Rates”

The yield curve, a major source of volatility last year, continues to be in an odd position. The short-end of the curve, influenced by Fed rate hikes, is still inverted. This is normally a warning sign for the economy.

However, there are two important facts to keep in mind. First, there are many external factors affecting the yield curve today. Global interest rates continue to be low – especially in places like Europe – which has put downward pressure on U.S. rates. Additionally, the fact that the Fed has put its rate hikes on pause has kept rates stable on the short end of the curve.

Second, even when the yield curve does signal recession, this is typically not an overnight event, but a process that takes time. The standard definition of yield curve inversion focuses on the 10-year and 2-year yields. While this measure is extremely flat, it has not officially inverted yet.

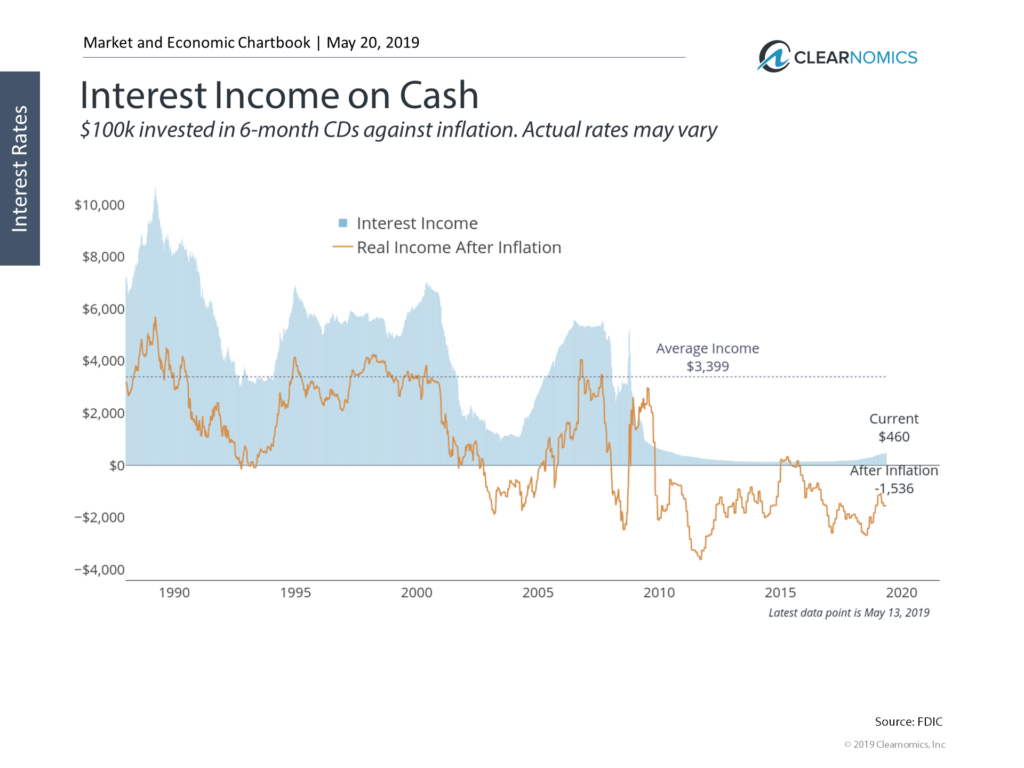

3. Generating portfolio income still requires discipline and the expertise to balance risk

Interest Income on Cash

Find this chart under “Interest Rates”

The good news for many investors is that short-term rates remain higher than at any other point in this market cycle. As a result, the income generated from cash in savings accounts, certificates of deposit, and other short-term vehicles has increased.

The bad news is that these rates haven’t kept pace with inflation. The average national rate on 6-month CD’s with $100,000 or greater is still only 0.46%. Of course, there are specific vehicles and accounts with much higher rates, but this suggests that the average American is still earning little at a time when most consumer prices are rising 2% annually.

The bottom line for investors? Interest rates are still low, the result of recent volatility and the culmination of a four-decade trend. Investors should stay disciplined and patient as they seek long-term portfolio income.