Coronavirus Impact on Financial Markets

The global financial markets have taken a very serious turn as they assess the spread of the coronavirus. The death rate of those affected thankfully appears to be minimal compared to other epidemics, but the human toll should not be downplayed or overlooked. Nevertheless, the short-term adjustment in equity prices has been more globally contagious. It’s important for investors to maintain perspective and separate investment decisions from how we, collectively, may respond to a global health scare.

It is naturally appropriate to adhere to travel restrictions, pay more attention to our basic everyday hygiene, and take sensible precautions. In our financial lives, it is also important to manage our natural behavioral instincts of becoming fearful or greedy in different times. This is not a time for a financial overreaction to a fearful medical event. Why?

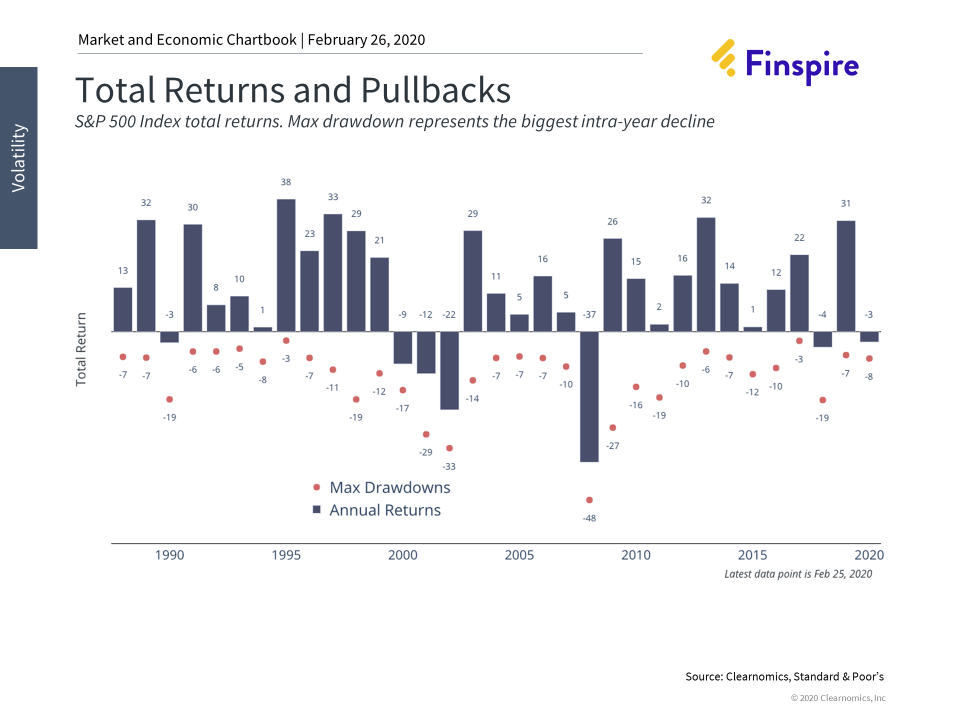

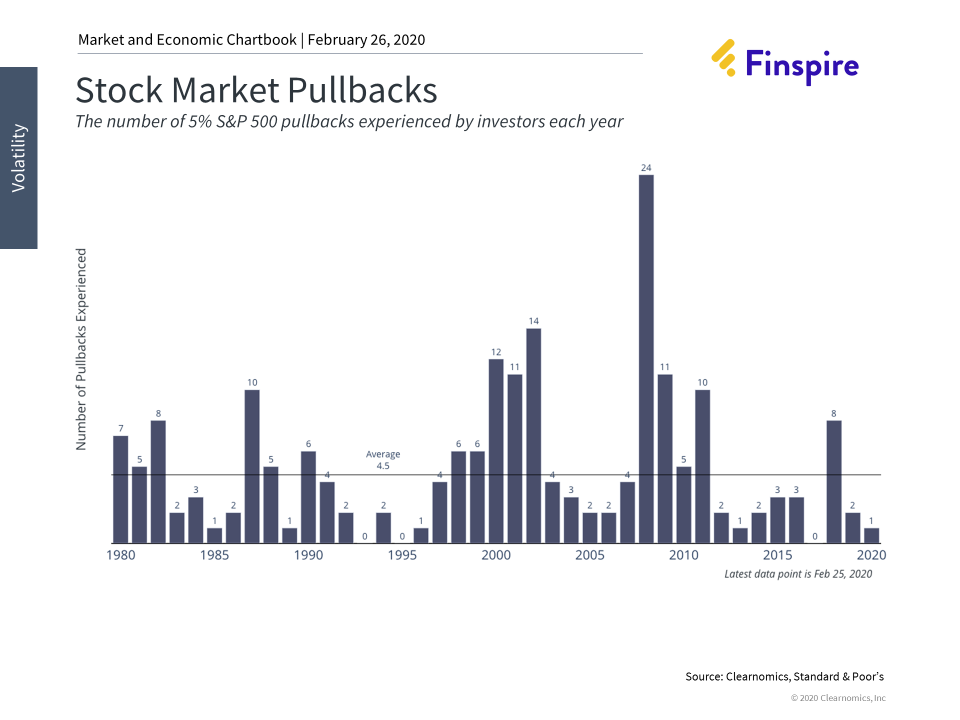

The US Stock Market has pulled back approximately 8% from its recent all-time high. Year-to-date, the S&P 500 has fallen 3.2%. Global markets have also experienced increased volatility with the MSCI Emerging Markets index and the MSCI Developed Markets index falling 5% and 6% year-to-date, respectively. Globally speaking, the MSCI All Country World index is down about 4% this year. This happens quite regularly even during historical calendar years when markets finish positively.

It’s important to keep all of this in perspective. While global markets are negative two months into the new year, they are still quite positive on a year-over-year basis. Despite this recent decline, the S&P 500 has gained 14% with dividends over the past twelve months. Short-term market pullbacks of this magnitude occur frequently. It’s not unusual for the market to decline 5, 10 or 15% on a short-term basis.

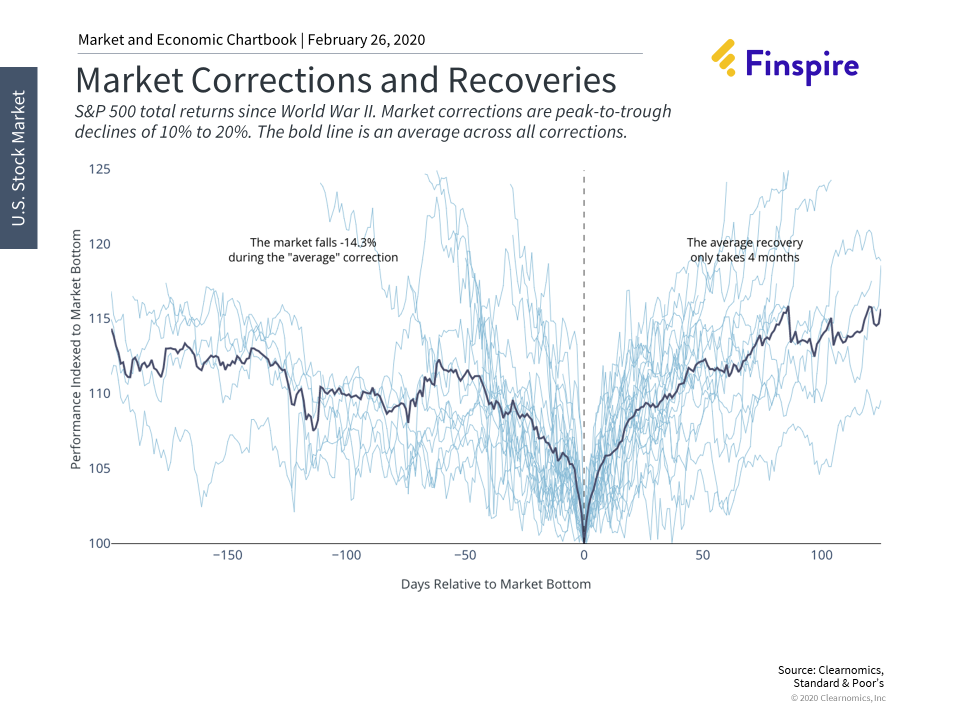

Historically, many market corrections reverse in a matter of months, and those few that do become full-fledged bear markets do so because of recessions, extreme valuations or major policy blunders by the Fed. Regardless of how one feels about the current market and business cycles, recent market swings most likely have little to do with these factors.

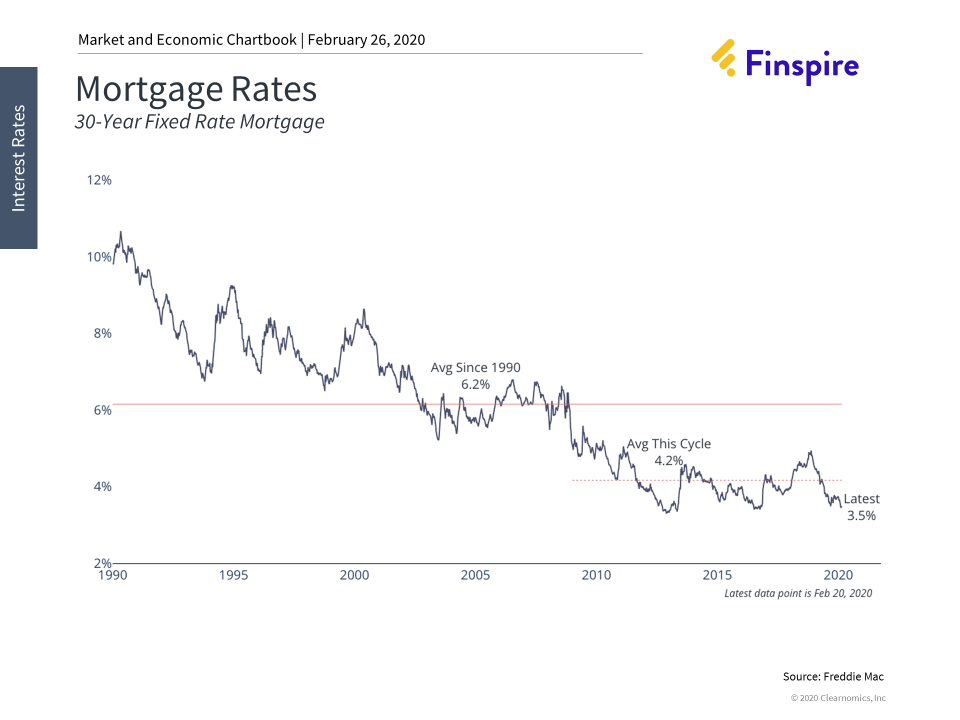

While the equity markets have performed poorly over this very short period, diversified portfolios with fixed income exposure have been able minimize their drawdowns. The 10-year Treasury yield is now under 1.4%, plunging below its 2019 low of 1.45%. In fact, this is one of the lowest levels for long-term Treasury yields since before the 2016 presidential election. This has translated not just to positive bond value performance, but further expands access to inexpensive mortgages rates.

Times like these offer reminders of the benefits of a well-designed asset allocation approach. Investors should focus not on short-term gains and losses but on achieving their investment objectives and financial goals.

The bottom line. It’s unclear when the new coronavirus will be contained. What is clear, however, is that market swings are normal and expected. Investors should hold appropriate portfolios that anticipate periods of market volatility while still focusing on achieving their long-term goals.

MSCI (Morgan Stanley Capital Investment) Emerging Markets Index – is an index used to measure equity market performance in global emerging markets. MSCI Emerging Markets Index stands for Morgan Stanley Capital International (MSCI), and is an index used to measure equity market performance in global emerging markets. MSCI All Country World Index (ACWI) is a market capitalization weighted index designed to provide a broad measure of equity market performance throughout the world. You cannot invest directly in an index. Diversification and asset allocation do not guarantee returns or protect against losses.