The Corn Maze – Write-up

A field guide through

THE CORN MAZE

by CHRIS KARAM, CIMA®

Chief Investment Officer

Finspire, LLC

October 6, 2022

Every October we get a chance to embrace sweater weather and get to enjoy the outdoors with family, friends and, of course, football. It culminates with Halloween, but the month usually features a visit to a pumpkin patch, apple orchard, or a good costume party. I have three children and, when they were a little younger, the corn maze never disappointed, especially when we visited with friends. The oldest kids were always trying to scare the youngest ones and a good maze has corn stalks that grow above your eye level making the journey with a lack of visibility a bit more mysterious. A few dead ends and detours later and we eventually find a path to the exit where the apple cider, popcorn and donuts await.

Entering the Maze

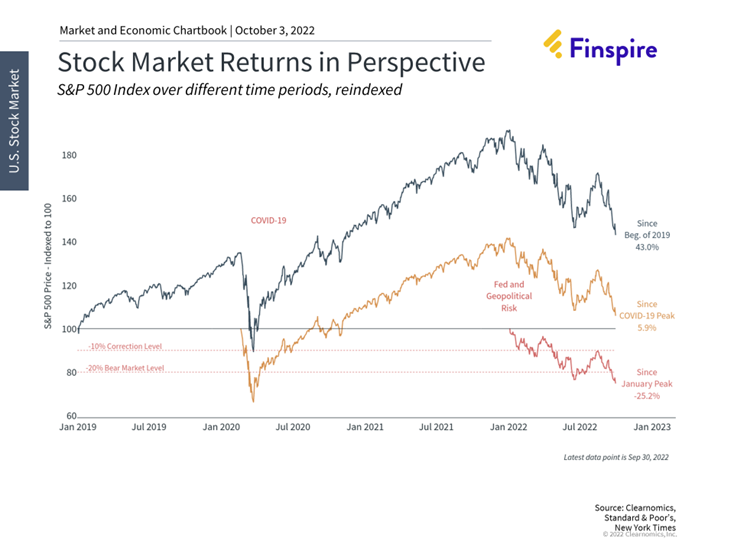

The current capital markets remind me of a good corn maze. We entered the 2022 maze cautiously after two years of above average returns, economic growth, low inflation, earnings momentum, and steady interest rates. The economic stimuli from the Federal Reserve and Congress were kicking into full gear as earnings growth gathered steam and consumers reengaged in the broader economy. We do need to have some perspective on this year’s equity market as we tangle with rising interest rates and tightening financial conditions relative to the easy financial conditions stemming from the 2020 bear market and trillions of dollars of monetary and fiscal support. Despite this year’s disappointing environment, the S&P 500 remained at +5.9% since the market peak reached before COVID.

The Labyrinth

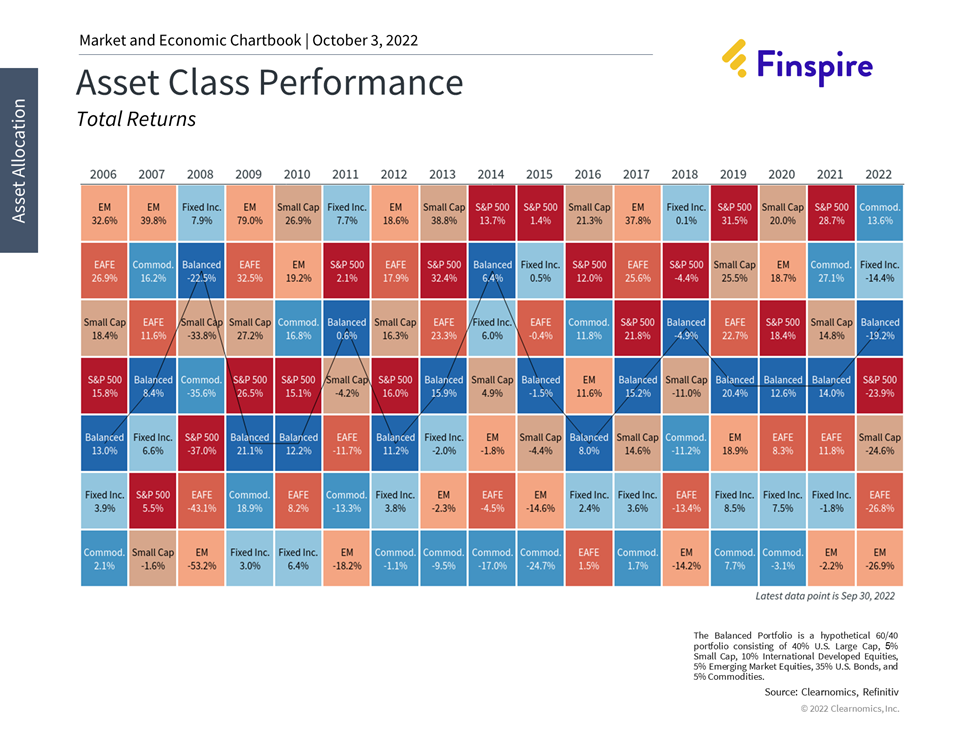

It turns out this year’s maze has had more than the average number of dead ends and directionless instincts. Chief amongst those dead ends is the concept that bonds have not necessarily aided the equity market drawdown. We are experiencing an unprecedented time in fixed income, but even after the tumultuously volatile interest rate environment in the first three quarters of 2022, investment grade bonds were still the second best performing broad asset class – behind commodities – as of 9/30/2022.

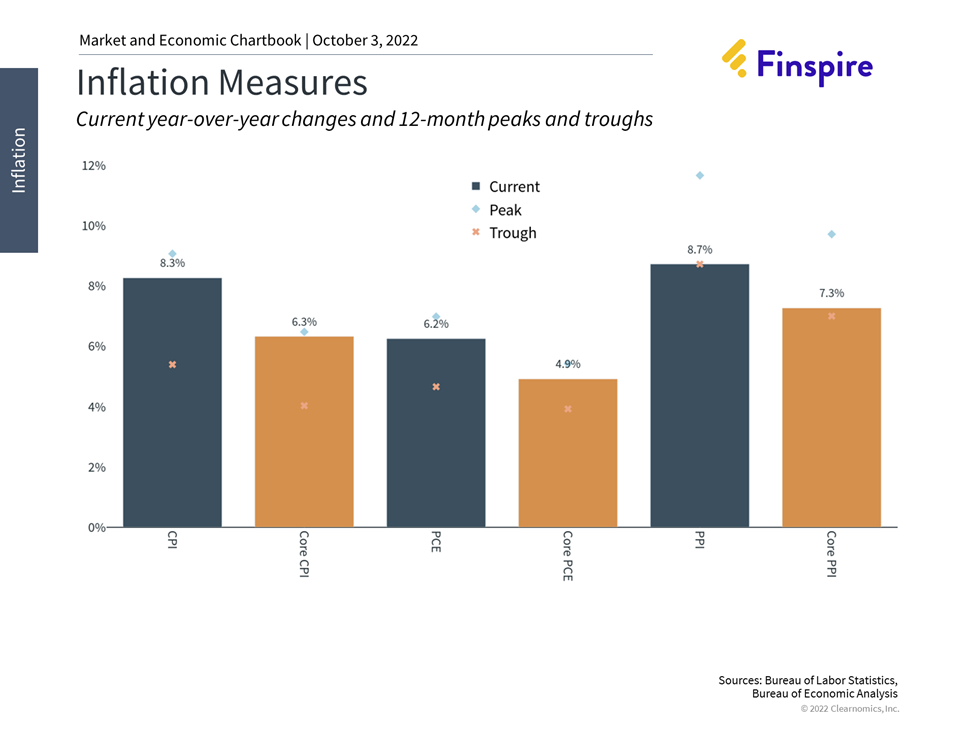

The highest corn stalks clearly remain inflation and interest rates – they grow hand in hand. Three of the most common measurements of inflation – Consumer Price Index (“CPI”), Personal Consumption Expenditures (“PCE”) and Producer Price Index (“PPI”) – peaked in June of this year and are now in a favorable downward trend, albeit at a slower pace than the markets desire. Rising interest rates is bringing a large segment of the economy – housing – to a snail’s pace, which should stymie the component of inflation associated with cost of shelter. CPI gets most of the financial press headlines, but the Federal Reserve maintains a long-term Core PCE inflation target of 2% [currently 4.9%].

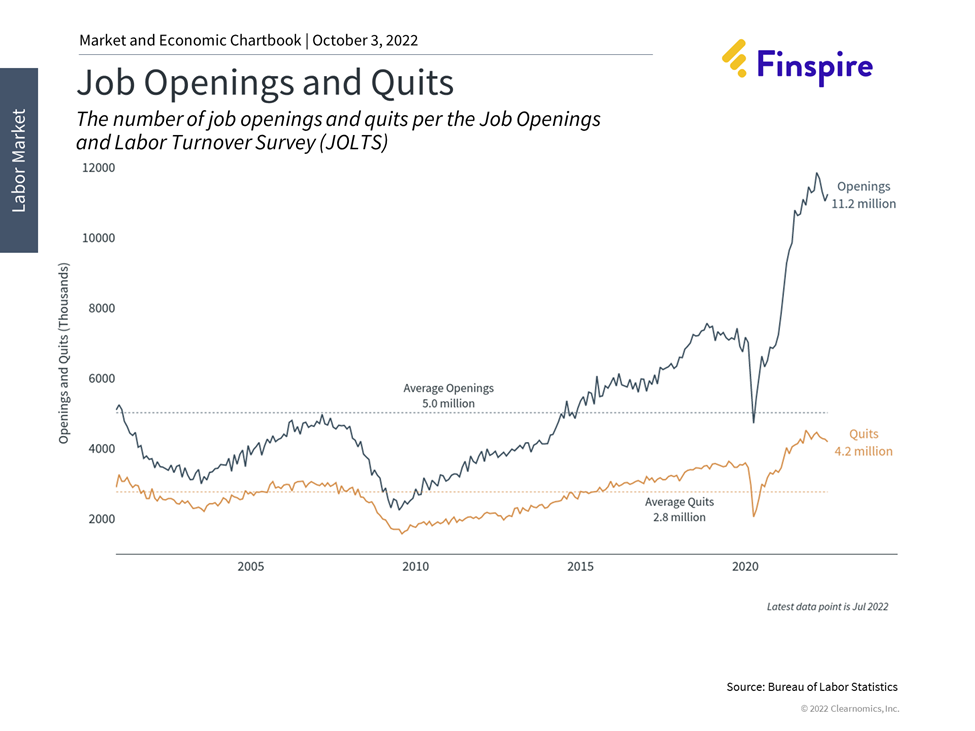

The latest Job Openings and Labor Turnover Survey (“JOLTS”) report, released on October 4th, finally issued a significant reduction in the number of available jobs – down to 10.1 million from 11.2 million. Ordinarily this is economically undesirable, but the Federal Reserve has been eagerly anticipating a reduction in the huge chasm between the number of available jobs versus the number of people seeking work in order to “moderate” economic activity and correspondingly bring inflation down.

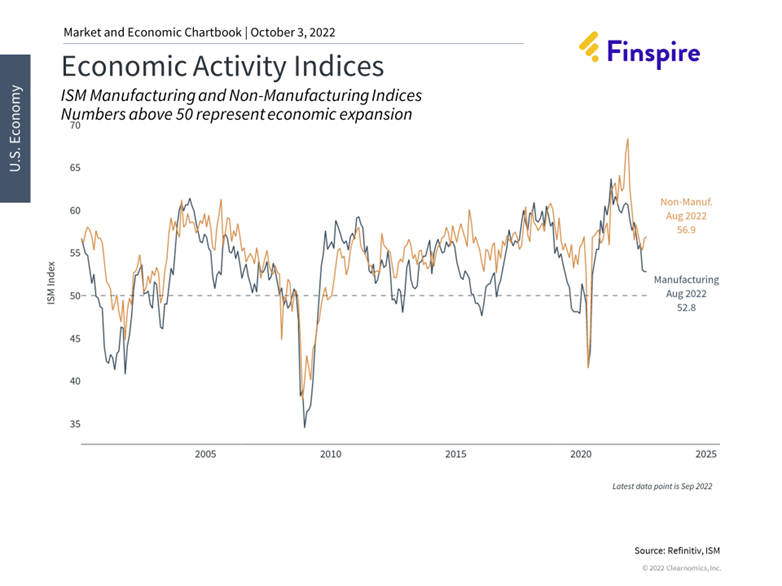

Recent news from the Institute of Supply Management (“ISM”) services survey – released on October 5th, delivered some positive economic news. Not only did the metric signal economic expansion, but it also indicated the Services sector is expanding at a reduced cost of doing business due to improvements in the supply chain. With another couple months of validation, this combination of economic data could be worthy of dampening inflation and be simultaneously supportive of equity and fixed income prices.

The Path Forward

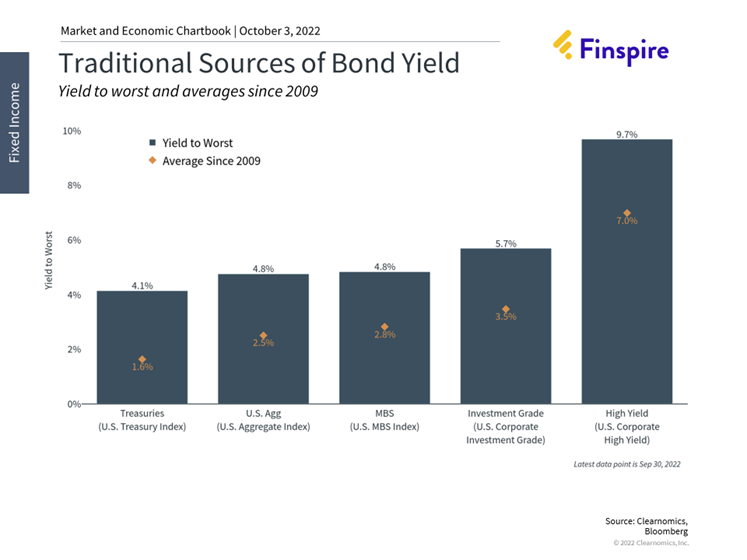

Sometimes the scarecrow offers us a clue to the correct path ahead. We have now reached a point in time where the rapidly rising rates have translated to significant yield opportunities in fixed income. Even the lower risk shorter-term US Treasuries were offering yields north of 4%. Investors will be potentially handsomely rewarded by assuming risk associated with investment grade corporate bonds.

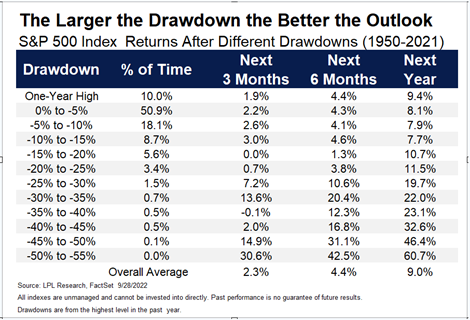

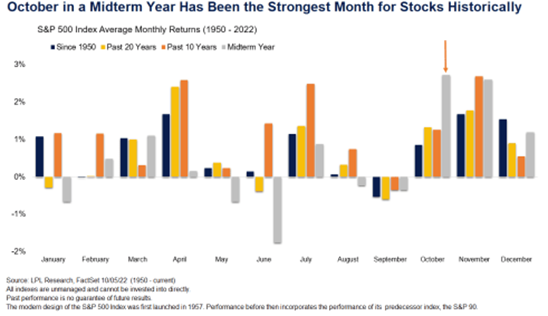

The opportunities are not limited to fixed income. History tells us that the larger the equity market drawdown the better the outlook. You can couple that with the month of October during a midterm election year being historically the strongest month for stocks. Good companies with competitive advantages and positive free cash flow – selling at a discount – may be a good way to invest new equity allocations.

We may have entered this year’s corn maze anticipating some detours filled with escalated volatility, but the fourth quarter may offer a path forward for validating the downward trend in inflation, strategically investing in fixed income and a volatile equity market. Come join us for a cup of apple cider and donuts.

Important Disclosures:

The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), IFP Securities LLC, dba Independent Financial Partners (IFP), and it advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors.