This Volatility is Normal

On the surface, the stock market has been eerily calm this year until recently, rising in almost a straight line from last Christmas through last week. The shift in investor sentiment over that period has been dramatic, swinging from fears of an impending bear market to a sense of complacency. What should investors expect going forward and how should they react to it?

Disciplined long-term investors understand that managing volatility is a normal part of investing. While we can be grateful for swift market rallies like the one we’ve seen this year, we should not expect these to last forever, and certainly not without a few bumps in the road. Staying invested for the long run requires seeing beyond recent market patterns and concerns.

While markets have experienced greater volatility over the past week, this should also be viewed with perspective. First, the VIX index, a popular gauge of market “fear,” was at unsustainably low levels for much of this year. And while it has increased, it is still only around the historical average. The largest stock market pullback this year is still only a few percentage points in magnitude.

Second, many of the issues driving market concern are ones that are already familiar to investors. The stalled U.S.-China trade talks, for instance, have weighed on markets for well over a year. Rising tariffs and the threat of a protracted trade war are, unfortunately, not likely to be resolved any time soon. But at the same time, this also doesn’t justify significant long-term concern or dramatic portfolio shifts for patient investors.

Third, it’s important to remember that we’re later in the business cycle and that volatility should increase over time. We should not be surprised by daily, weekly, or even monthly swings that are much larger than what we’ve grown accustomed to over the past several years. The historical average decline that the S&P 500 experiences each year is about -13%. Over the past seven years, only one year has seen this level of pullback or worse: last year. Even that period of volatility was short-lived.

For long-term investors seeking to protect and grow wealth over many years and decades, it’s clear that market timing is often counterproductive. The goal isn’t to swerve around every pothole. Not only is this dangerous, but some bumps are entirely unforeseen or unavoidable. The goal is to set yourself up for a balanced ride, regardless of the terrain.

Below are three charts that highlight the importance of staying invested.

1. Volatility has been extremely low until now

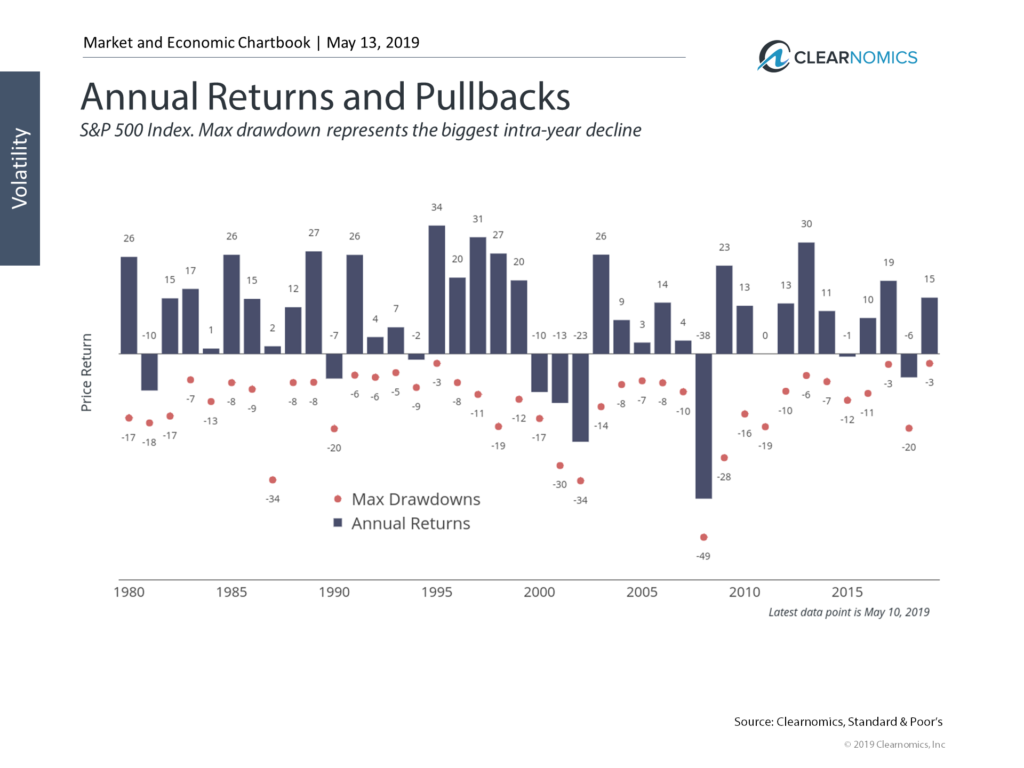

Annual Returns and Pullbacks

Find this chart under “Volatility and Staying Invested”

Staying invested in volatile markets is a key principle of investment success. For some investors, however, this may be especially challenging given the market calm we’ve benefited from this year.

This chart shows each year’s stock market return (bars) compared to the worst pullback during the year (dots). In 2017, the worst pullback was less than 3%, the lowest since 1995. Such a low level of volatility is highly unusual since almost every year experiences a market pullback of at least 5%. The average intra-year decline since World War II comes in at -13.4%.

The largest decline this year, as of last Friday, has only been -2.5%. As the chart above shows, this is extremely low by historical standards. It would not be unreasonable for investors to expect greater levels of volatility going forward.

2. Markets tend to recover if the fundamentals are sound

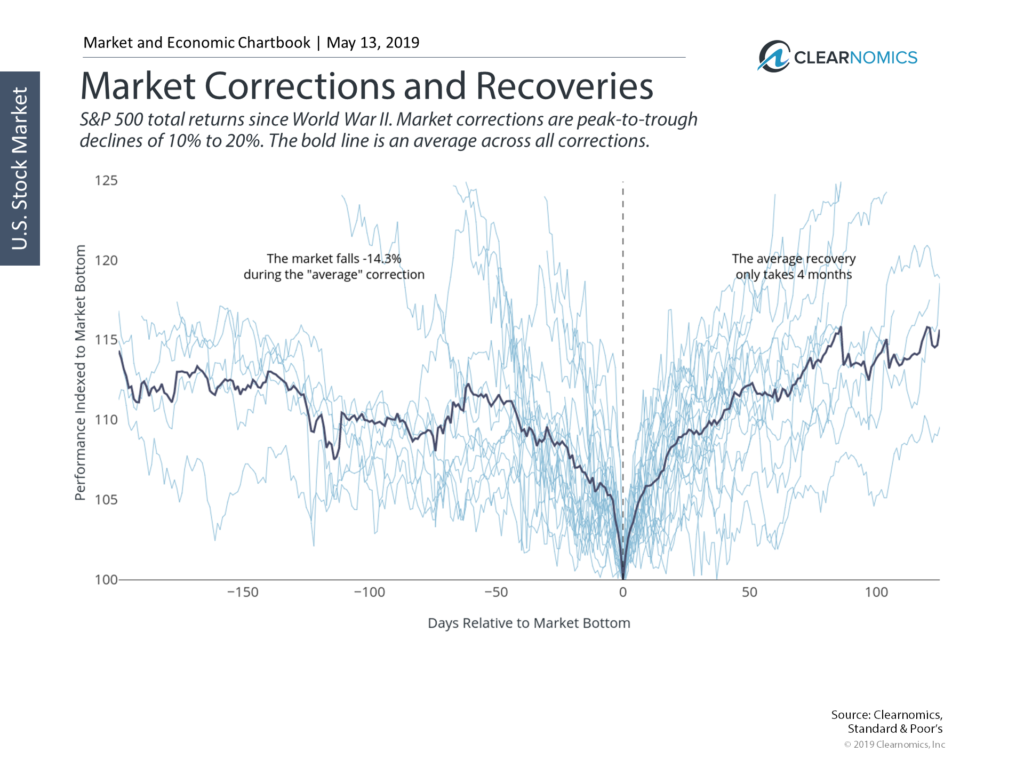

Corrections and Recoveries

Find this chart under “Volatility and Staying Invested”

In hindsight, last year’s market rebound was similar to historical periods of market volatility. The fact that the recovery took about four months is exactly in line with the historical average.

While the exact timing may be a coincidence, the broader story is that market corrections and recoveries are normal. Investors should not be surprised by market pullbacks – they can occur at any time and without warning – nor should they be surprised when markets recover.

3. Market timing is tempting but is often counter-productive

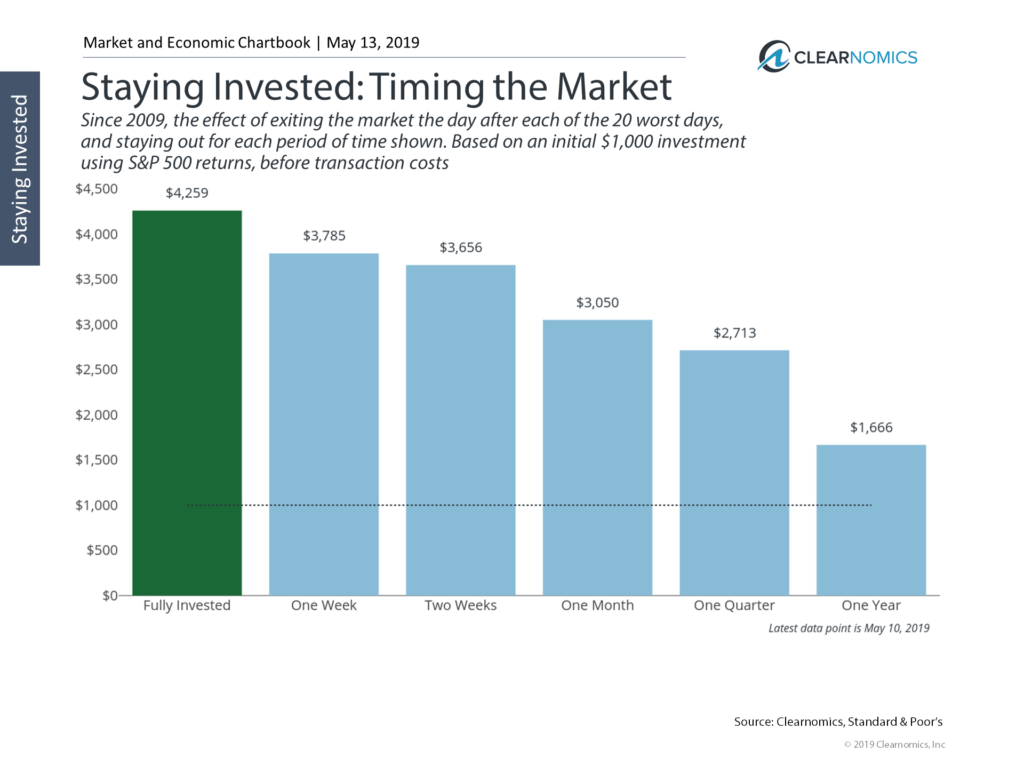

Market Timing

Find this chart under “Volatility and Staying Invested”

In response to volatility, it’s natural for many investors to be tempted to jump in and out of the markets. The problem with attempting to time the market is that it’s often reactive. Not only do investors need to find an exit point after markets have already fallen, but must also decide when to re-enter later.

This chart shows the hypothetical result of exiting the market the day after large declines and staying out of the market for various periods of time. Since markets trend upward, the longer one stays on the sidelines, the more likely they are to miss investment gains. Those who are hesitant to re-enter after experiencing the safety of holding cash are likely to miss out even more.

Additionally, these numbers are before transactions costs and other fees. Thus, the outperformance of staying invested is most likely even greater.

The bottom line for investors? Volatility has been extremely low this year as the market has recovered from last year’s pullback. It’s important for investors to stay disciplined as volatility picks up.