Looking Beyond the Wuhan Virus

Recent developments in the reaction to the spread of the Wuhan Virus included President Trump imposing a travel ban on flights coming into the USA from mainland Europe. Market forces have driven values on the S&P 500 into bear market territory, a descriptor applied when a market index loses over 20% of its value from its peak. The market is, thus far, responding sharply negatively to the ramifications of economic hardships of the restrictions placed on our economic activity to control the spread. The bear market on the S&P 500 index puts an end to an 11-year [nearly to the exact day] bull market run where the index rose a cumulative 305%.

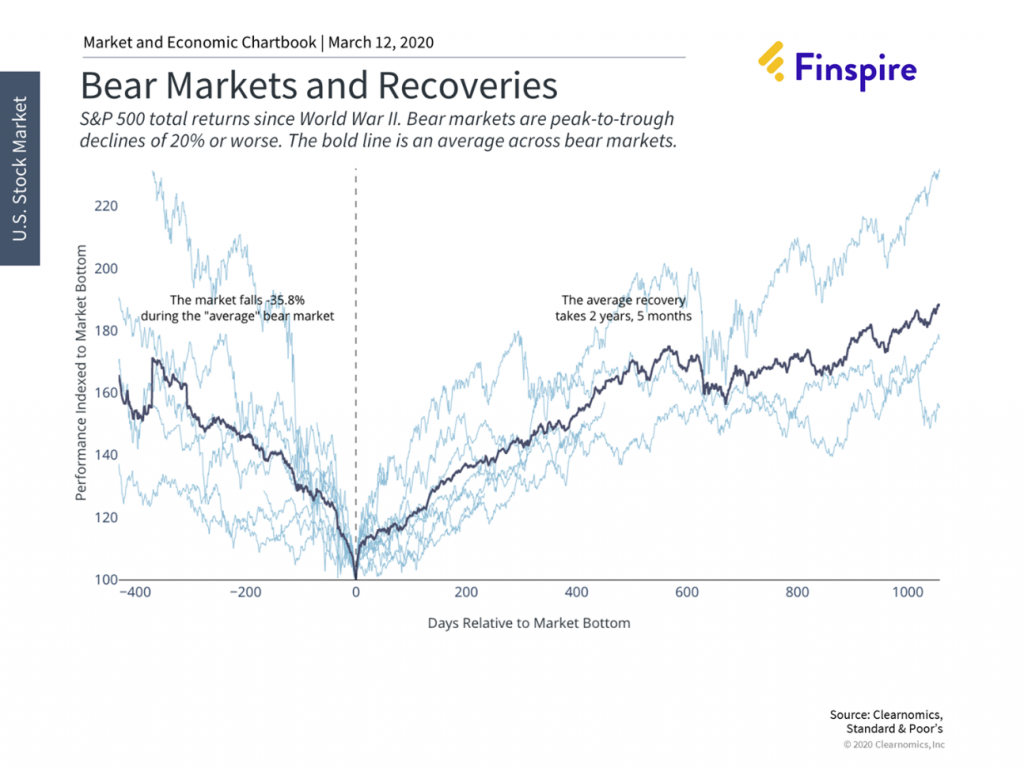

The average bear market since World War II has seen stock prices fall 35.8%, but ordinarily take 18 months to unfold. Recoveries from these levels take 2 years 5 months on average, depending on the underlying economy and fundamentals. This recent market reaction has been different than historical norms given our economic fundamentals were very strong going into the month of March. This bear market occurred far more quickly than previous ones and has great potential to experience one of the fastest recoveries should the spread of the virus begin to decline.

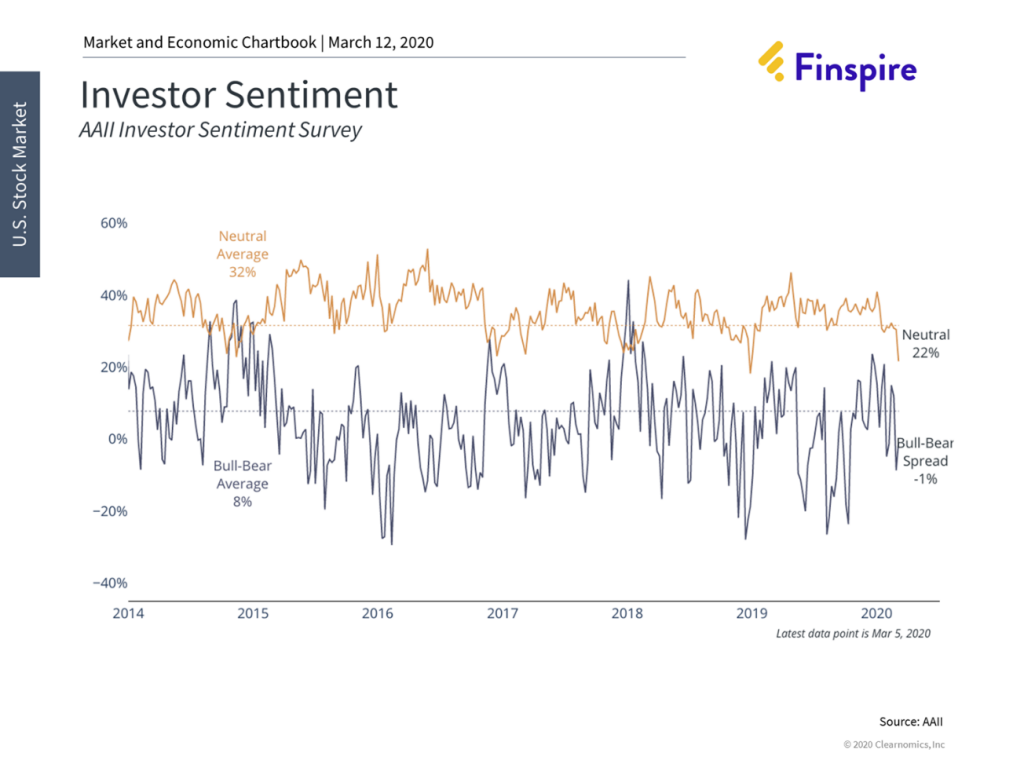

Not surprisingly, investor sentiment, which is a good psychological measure of future economic confidence, has fallen precipitously during this very recent time period. The American Association of Individual Investors Sentiment Survey is a weekly survey of its members which asks if they are “Bullish,” “Bearish,” or “Neutral” on the stock market over the next six months. The level of Neutral has declined and the level of Bearish responses has increased.

The Wuhan Virus is not the only major story weighing on markets this week. Last weekend, a geopolitical spat between Saudi Arabia and Russia resulted in suddenly dramatically lower oil prices with the Saudis increasing oil output during a period of already weakened global demand. This created an oil price shock drop by nearly 25% on Monday March 9th, which is favorable for gas consumption. Oil prices dipped to a level that may negatively impact the production and profitability of US producers of shale oil, further complicating the performance of US stocks. Oil price shocks greater than 20% have historically negatively impacted the S&P 500 equity market index.

Interest rates have also plummeted during this recent S&P 500 equity market drawdown. Low interest rates usually coincide with anticipated economic weakness and below target inflation. The Federal Reserve has already cut the short-term Federal Funds interest rate by 0.50% on March 3rd and is widely expected to do so again soon. The silver lining of lower interest rates is usually best expressed to consumers with lower mortgage costs and higher bond prices. This creates a very favorable environment for first-time home buyers and existing homeowners considering refinancing activity.

The bottom line is the US stock market has breached into bear market territory far more quickly than previous occurrences during the post-World War II period. This also means that a market recovery also has the potential to eclipse previous historical averages. An oil price shock further complicated the matter. The rapidity of public health policy changes is roiling the equity markets while interest rates plunge. Investors with cash on the sidelines and a modest to lengthy time horizon should consider a dollar cost averaging approach to buying long-term holdings and eyeing current equity market opportunities. We advise those who do not have cash on the sidelines to be careful trading out of long-term holdings during a highly volatile time and maintain their balanced approach.

Important Disclosures:

Investors cannot invest directly into an index. Past performance is no guarantee for future results. The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (“IFP”), IFP Securities LLC, dba Independent Financial Partners, and its advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. MSCI (Morgan Stanley Capital Investment) Emerging Markets Index – is an index used to measure equity market performance in global emerging markets. MSCI Emerging Markets Index stands for Morgan Stanley Capital International (MSCI), and is an index used to measure equity market performance in global emerging markets. MSCI All Country World Index (ACWI) is a market capitalization weighted index designed to provide a broad measure of equity market performance throughout the world. You cannot invest directly in an index. Diversification and asset allocation do not guarantee returns or protect against losses.