An Update on COVID-19

Investors are still grappling with the spread of the COVID-19 coronavirus. Global government entities are making concerted efforts to contain the virus that is spreading somewhat unlike previous epidemics. We continue to track the COVID-19 impact on the global economy going forward, fully aware that the recent positive news regarding the February 2020 unemployment rate dropping to 3.5% was largely ignored. The longest economic expansion in US history is now facing its toughest challenge – a viral outbreak that has injected fear into the stability of the public’s health. We now must dissect the topics of public health, the global economy and visceral market reactions, by examining the following:

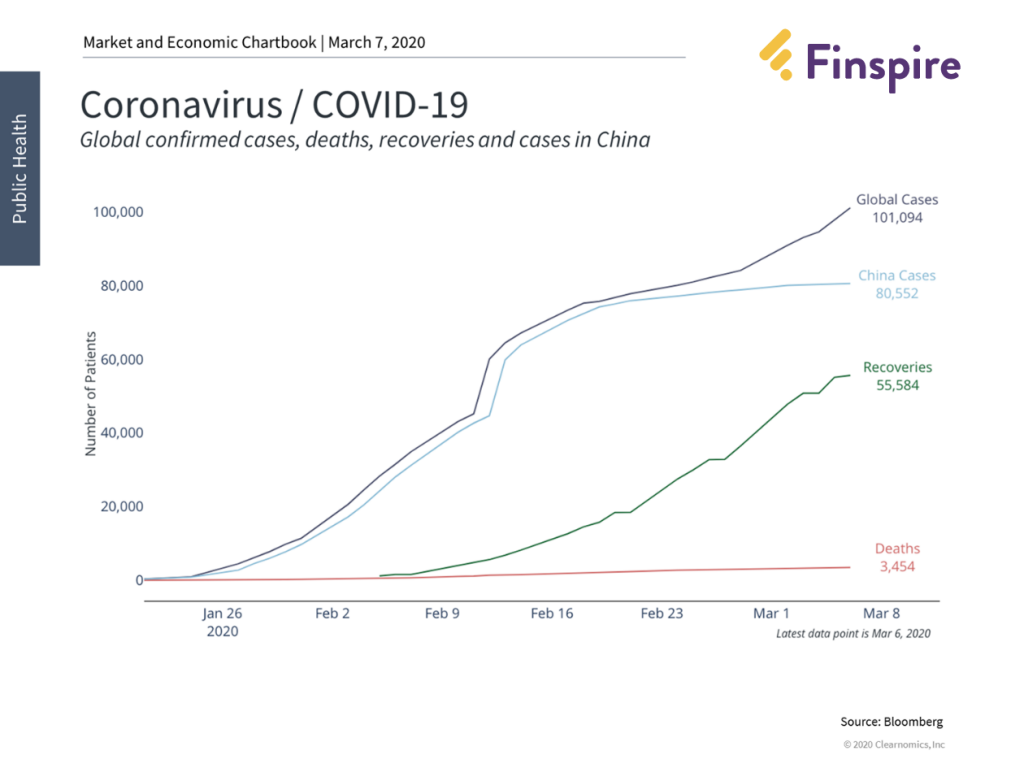

1. How Widespread is COVID-19?

We are not global health or medical experts and we can only rely on published data while not extrapolating into future figures. The data currently show the confirmed cases continue to rise but are slowing in China. The mortality rate has been between 2-3% – significantly higher than the seasonal flu – and the corresponding recovery rate has been high and rising.

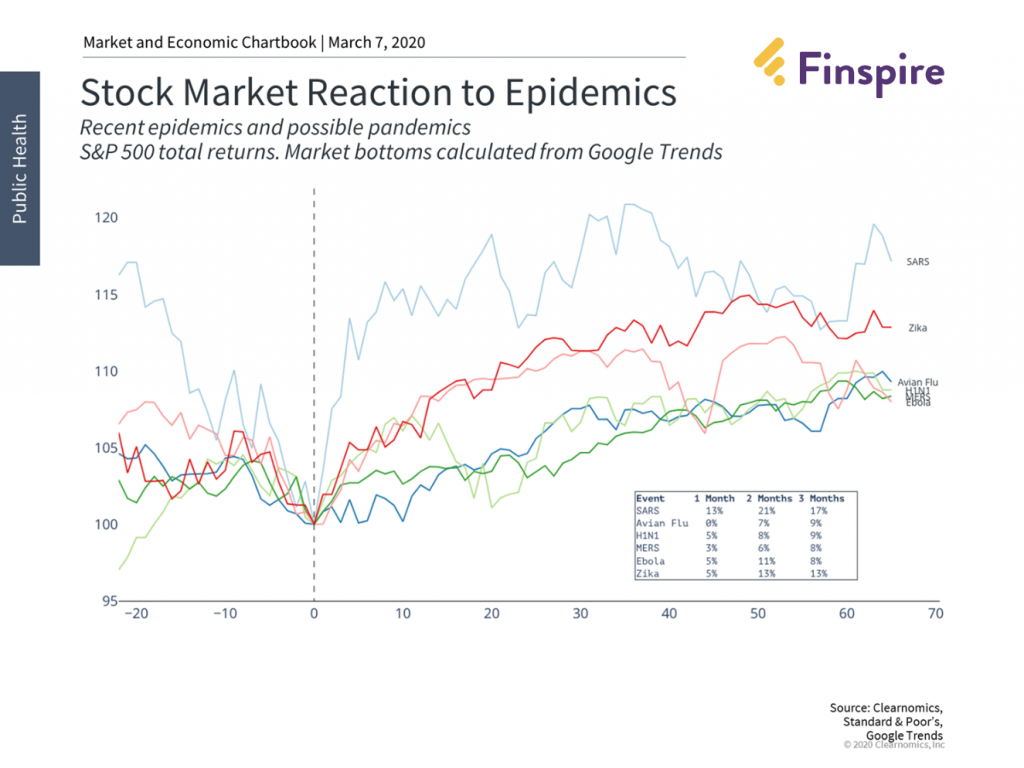

2. How have markets reacted to past epidemics/pandemics?

Markets tend to move sharply when the emotions of fear and greed overwhelm overall sentiment. COVID-19, like previous viral epidemics, are scary due to the unknown amount of disruption. Public health scares over the past two decades, including SARS, avian bird flu, H1N1, MERS, Ebola and Zika, resulted in public attention but had few lasting market reactions.

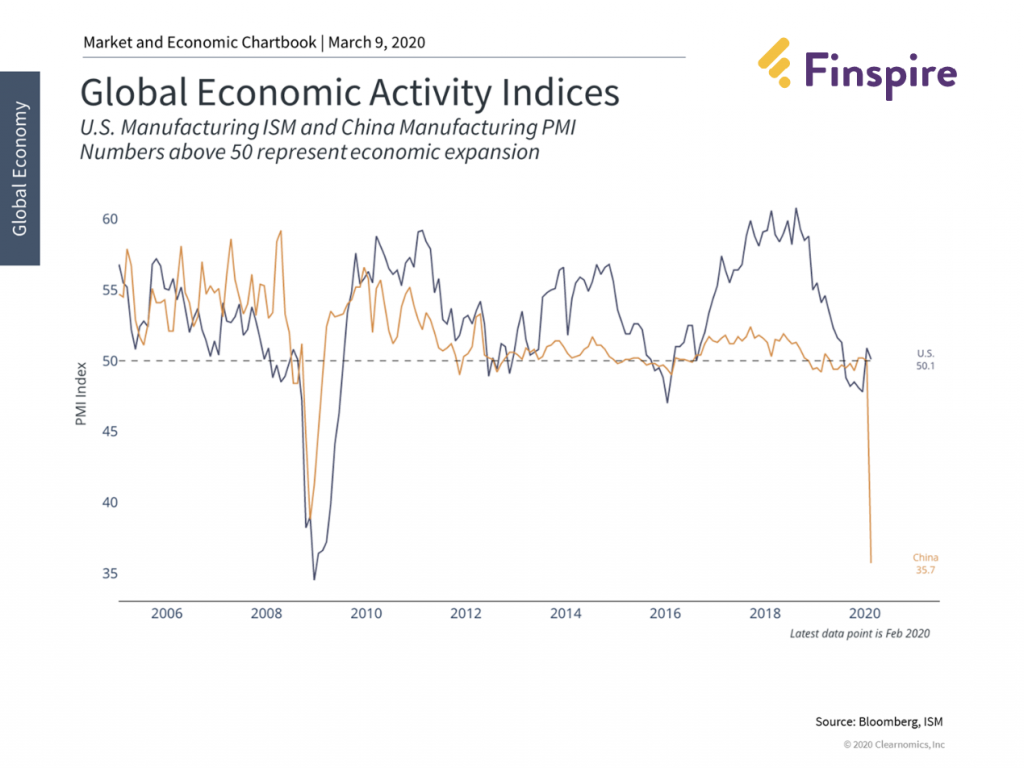

3. Will COVID-19 cause a recession?

The COVID-19 outbreak in China also coincided with the lunar new year, effectively prolonging the period during which industrial activity was shut down. U.S. companies have been reporting supply disruptions over the past two months as a result. Manufacturing activity in China and the U.S. has slowed recently due to Chinese cities being quarantined and shut down. It would be surprising if this continued to be the case once factories are back up and running, but the near-term data do indicate a global economic slowdown.

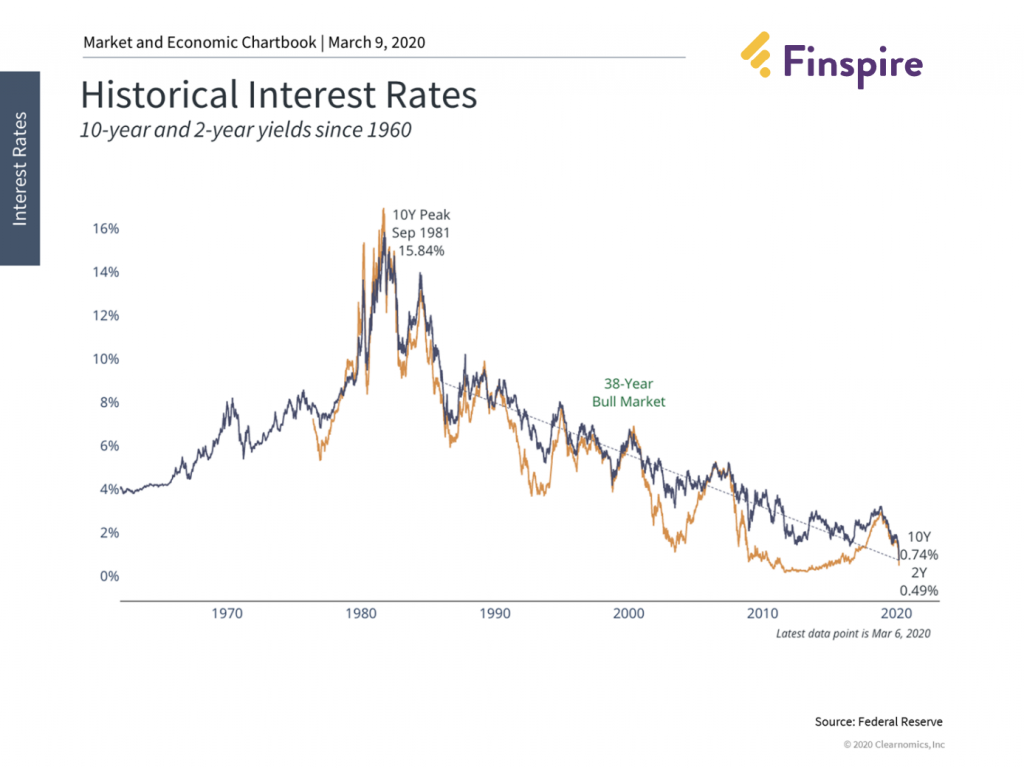

4. Why did the Federal Reserve cut interest rates?

Reductions in interest

rates cannot solve a public health crisis, but they can ease monetary

conditions during a time of economic stress.

Given the short-term economic data above, and to be cautious, the

Federal Reserve announced an emergency interest rate cut of one-half percent on

March 3rd. This was the first emergency move by the Fed since the

2008 global financial crisis and took place two weeks ahead of their scheduled

mid-March meeting. The Federal Funds Rate

currently resides at a range of 1 to 1.25% – a level last seen in 2017.

5. How might the US equity market respond?

The recent market pullback has pushed the overall stock market valuation levels last seen in 2018. Stock market valuations consider both current prices and future earnings expectations. Falling valuations suggest stock prices have declined faster than earnings expectations, potentially offering attractive purchasing opportunities for long-term investors. It is noteworthy that recent valuations are nowhere near the technology driven bubble from the year 2000.

The longest expansion in US history is now under attack by a viral public health outbreak. The unknowns related to the acceleration of its spread has caused significant short-term asset pricing adjustments for both stocks [lower] and bonds [higher]. Longer-term investors should be mindful of the current landscape and evaluate potential market opportunities.

MSCI (Morgan Stanley Capital Investment) Emerging Markets Index – is an index used to measure equity market performance in global emerging markets. MSCI Emerging Markets Index stands for Morgan Stanley Capital International (MSCI), and is an index used to measure equity market performance in global emerging markets. MSCI All Country World Index (ACWI) is a market capitalization weighted index designed to provide a broad measure of equity market performance throughout the world. You cannot invest directly in an index. Diversification and asset allocation do not guarantee returns or protect against losses.