It’s Not All About Russia

by CHRIS KARAM, CIMA®

Chief Investment Officer

Finspire, LLC

February 24, 2022

We are unfortunately aware of the Russian invasion of Ukraine during the overnight hours. US intelligence agencies, the US State Department and President Biden all warned of this plausible scenario and the Ukrainians find themselves in a terrible position. This military exercise is broader than the 2014 invasion of the Crimean Peninsula as Russian troops surrounded Ukraine on both the Russian and Belarusian borders. The opportunity for political and military miscalculation is high and our first concern is for the human lives that will be lost during this conflict.

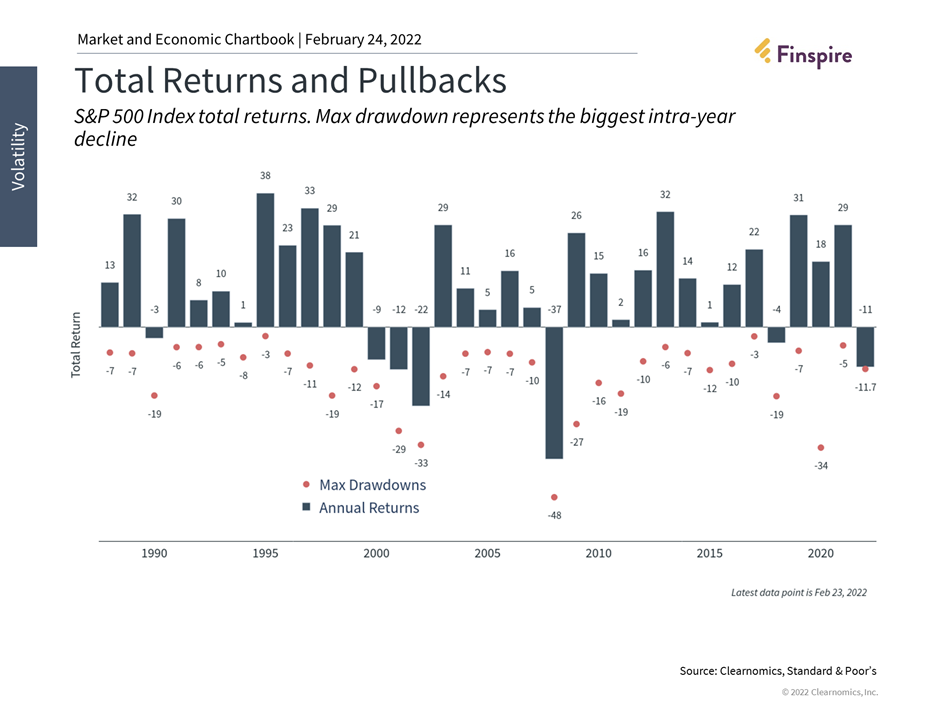

The S&P 500 officially entered correction territory yesterday and the overnight futures sold off sharply after the Russian invasion. Corrections are not uncommon and are quite normal even during years with positive total returns. The red dots below represent the largest pullback in each calendar year since 1988. The blue bar represents the total return achieved in that calendar year.

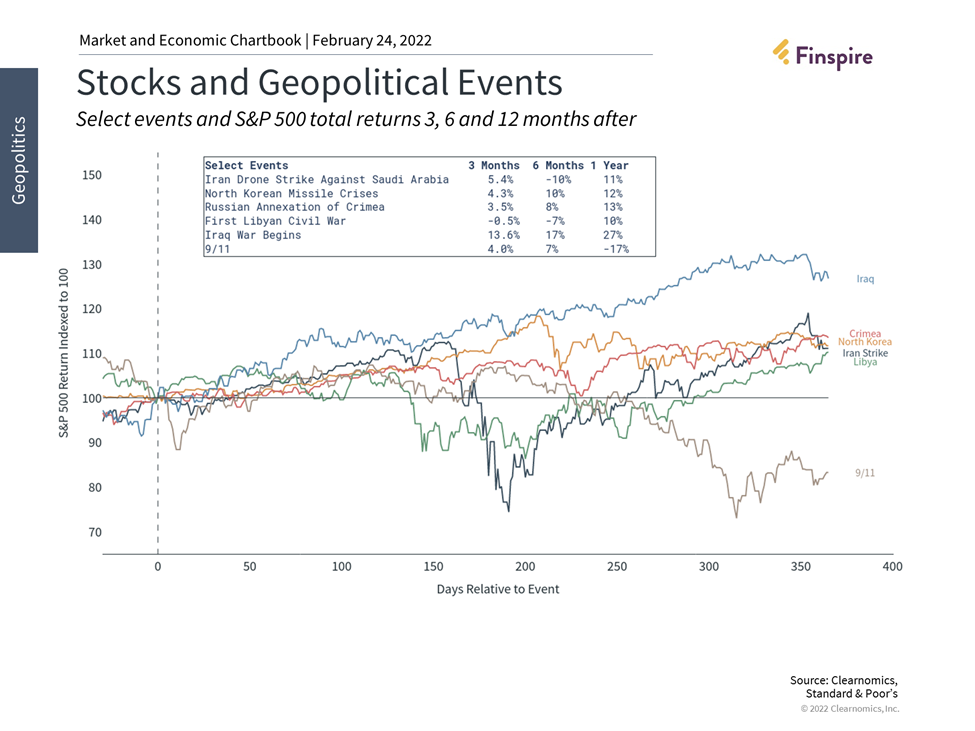

The last time Russia invaded the Crimean Peninsula, markets sold off very modestly and for a short time. The chart below shows how markets have reacted during different geopolitical wars and conflicts.

This market correction has been unfolding since the beginning of the year and is not only about Russia and the Ukraine. Rather, this correction has more to do the domino effect of higher oil prices leading to sustained levels of high inflation, which, in turn, will force the Federal Reserve to raise short-term interest rates sooner and more aggressively. This uncertainty has led to increased volatility. Why? Because the markets are a discounting mechanism of future corporate earnings and the higher the interest rates climb, the present values of those future earnings decline.

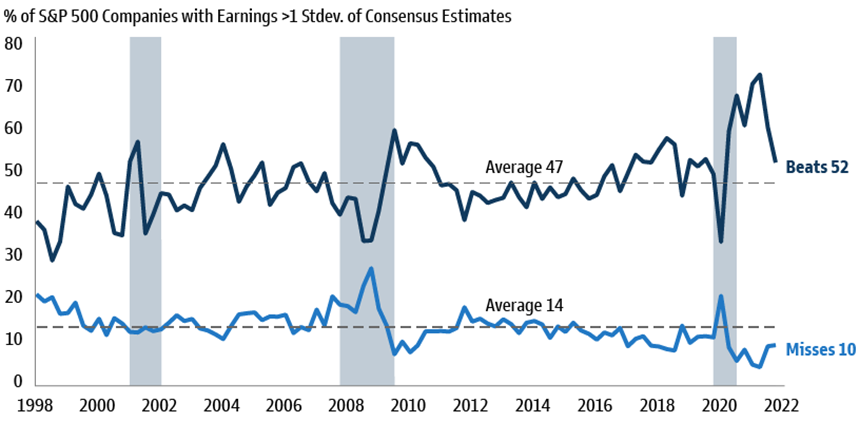

However, corporate earnings have, once again, remained strong. The chart below, courtesy of Goldman Sachs, show that of the 82% of earnings reports released as of 2/18/22, 52% have beaten consensus estimates, above the historical average of 47%. Only 10% of those have missed their consensus estimates, versus the historical average of 14%.

Furthermore, equities with healthy fundamentals and strong cash flow, have historically been a good way to manage inflation risk. The credit markets have, thus far, behaved relatively well in this environment which is an indication that this equity market correction is just that, a correction and one we will likely overcome throughout the year.

We are not standing still. We are taking the opportunity to install a small commodities and metals and mining position for moderate to aggressive risk profiles, further diversifying our fixed income posture by establishing a position in senior loans and increasing our allocating to an adaptive risk portfolio with the monthly flexibility to migrate from equities to bonds and vice versa based on economic and market conditions.

We are here to help you navigate these challenging market and economic environments and please feel free to call, e-mail or schedule time with us at a time of your choosing.

Important Disclosures:

The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), IFP Securities LLC, dba Independent Financial Partners (IFP), and it advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors.